To Our Investors and Friends,

The S&P 500 finished the year up 16.4% in 2025, which follows 2024 up 23.3% and 2023 up 24.2%. This recent market enthusiasm began with OpenAI’s introduction of ChatGPT at the end of November 2022 and has carried the market since. Excitement surrounding the future of this new technology is dominating everything, including GDP growth. The 10-Year Treasury bond has been supportive, finishing the year at 4.18% from 4.58% this time last year, while the 2-Year Treasury note fell 78 bps to end the year at 3.47%. Inflation has been stubborn at around 3%, but oil took off some of the pressure, closing the year down almost 20% to $57 a barrel. As was the case over the last several years, large growth outperformed all other major indexes. The Russell 1000 Growth Index ended the year up 18.6%, with the Russell 1000 Value Index up 16.9%. This was followed by the Russell 2000 Growth Index’s 13.0% gain and the Russell 2000 Value Index’s 12.6% increase.

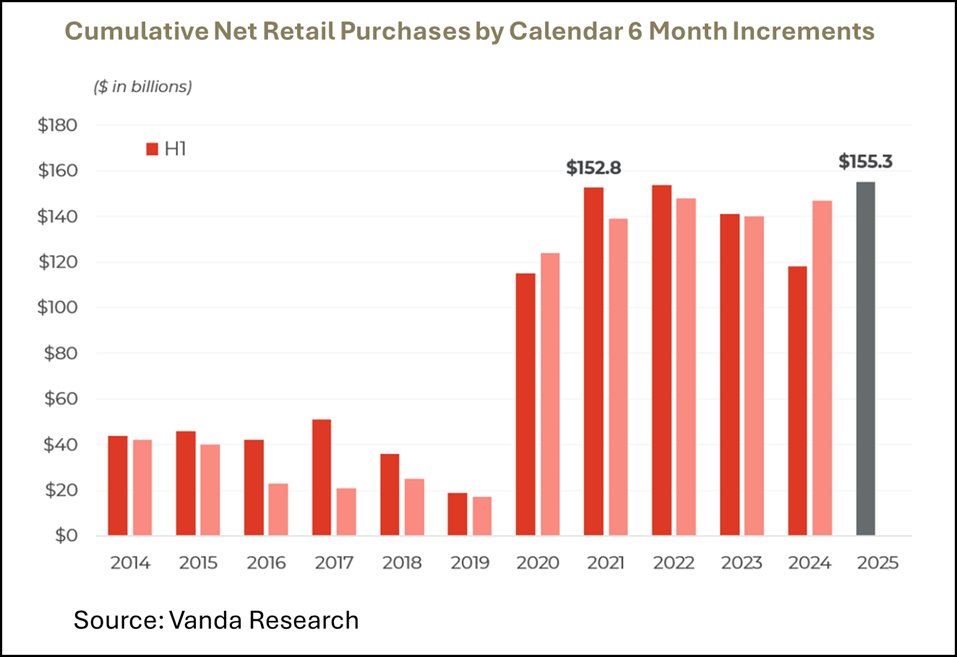

Over long periods of time, market returns track earnings growth of the index components, but over shorter time frames, the enthusiasm of the crowd plays a bigger role. As can be seen in the chart below, recent studies by JP Morgan, Vanda Research, and Citadel Securities have shown an increase in retail trading volume from less than 10% before the pandemic, to as high as 36% at the end of April this year. New tools and platforms have made the ability to trade easier than ever, but the driving forces determining the success of investors have not. Ultimately, successful investing is determined by correctly predicting a company’s earnings power and owning the stock as new investors buy at higher stock prices to benefit from that greater earnings power.

“The New York Times ran a story that…signaled a market top. The article was titled ‘The Magnet of Dancing Stock Prices’ and it stated plainly, ‘The people who know the least about the stock market have made the most money out of it in the last few months. Fools who rushed in where wise men feared to tread ran up high gains. Even such a veteran of markets as Charles M Schwab had declared that probably the old timers, who usually play the market by note, are behind the times and wrong, and that the new crop of speculators who play entirely by ear are right and that a new speculative era has dawned’.” This was not a recent story, but one that author Andrew Ross Sorkin quoted in his book 1929, Inside the Greatest Crash in Wall Street History – And How it Shattered a Nation. The human dynamic in stock investing is as old as the market itself, and should remind us all that our tendency is to follow the crowd into stocks that are rising with little regard for when that trend could end.

At Kingsland Investments, we are continually learning about AI through consistent use of several AI chat bots and reviewing videos ranging from Stanford professors teaching AI and industry leaders explaining the advancements of AI. We remain at the dawn of the AI era, and it most certainly will change the way we do everything. Speculation is part of investing, but at Kingsland Investments, we seek to limit speculation to the probable.

All the best to you,

Arthur K. Weise, CFA